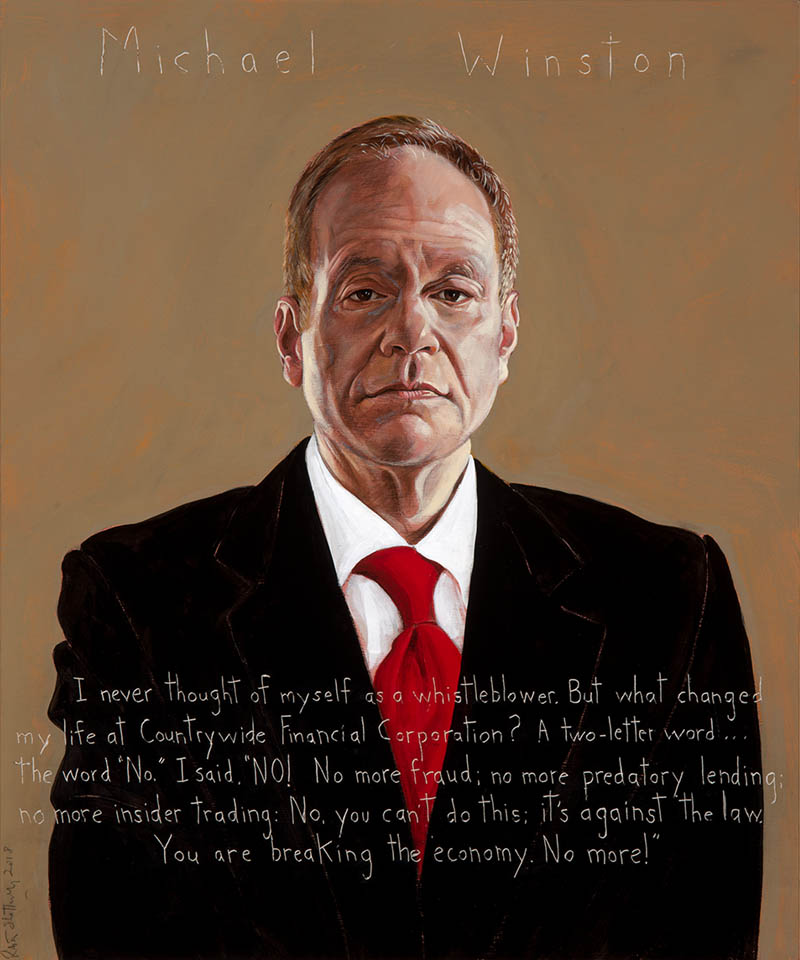

Michael Winston

Business Executive : b. 1951

“I never thought of myself as a whistleblower. But what changed my life at Countrywide Financial Corporation? A two letter word…the word ‘No’. I said, ‘NO! No more fraud; no more predatory lending; no more insider trading: No, you can’t do this, it’s against the law. You are breaking the economy. No more!’”

Biography

According to a Rolling Stone article published in 2015 by Matt Taibbi, “one of America’s ugliest secrets is that our own whistleblowers often don’t do so well after the headlines fade and cameras recede. The ones who don’t end up in jail… often…go through years of harassment and financial hardship.”

One of those whistleblowers still fighting to receive justice against unlawful retaliation and financial penalization is Michael Winston. Called by Salon Magazine “The Man Who Knows Too Much…”, he lost nearly everything after trying to tell the truth about Countrywide Financial Corporation (CFC).

Winston earned his Ph.D. from the University of Illinois, his Master’s Degree from the University of Notre Dame and completed higher learning programs for executive business at both Stanford University and University of Pennsylvania’s Wharton School. He then held executive positions in fortune 500 companies for over thirty years, including Motorola, Merrill Lynch, McDonnell Douglas, and Lockheed. In 2005, he was named Managing Director and Enterprise Chief Leadership Officer for Countrywide Financial Corporation. Countrywide hired him to help them build what they called “Goldman Sachs on the Pacific.” There he created strategic leadership models, quickly earning two major promotions and a performance award as he was commended by top executives for his “hard work, tenacity, insight and impact”. Winston’s recognition extended beyond the company: He was included in the Executive Excellence Journals’ list of the “100 Most Influential Business Thought-Leaders in the World”.

Shortly after being promoted, however, Winston began to unearth unlawful business practices at Countrywide including fraud, market manipulation, and insider trading. For months Winston encouraged reform from the inside. But bringing problematic issues to the attention of executive management, along with suspicions of unsafe working conditions, only brought Winston trouble. His concerns were ignored, and he was demoted. According to Winston’s lawyer Winston was punished by being “relocated seven times in as many months, each time to a different city. He was uninvited to meetings he would have led, was ostracized and saw his responsibilities gradually shrink to a fraction of what they had been.”

However, Winston’s resolve to implement reform only intensified. For the next two years, the more Countrywide retaliated against him, the harder he pushed back.

The situation reached a crisis point when Winston refused to lie about Countrywide’s corporate governance practices to Moody’s Investors Service, a prominent credit rating agency. Countrywide was always aware that its lending practices were managed for short-term gain and profit (e.g.., issuing “toxic” sub-prime loans that were for those without sufficient credit to afford the loan repayment. “Liar loans” flooded the sub-prime market with high percentages of those loans failing.)

Winston was discharged from the company in 2008; at which point he sued Countrywide and its acquiring company, Bank of America, for retaliation in violation of public policy, fraud, unlawful business practices, and wrongful termination.

Winston was thrust into the public eye in 2011 when his trial against Countrywide and Bank of America commenced. The trial lasted nearly a month as a jury reviewed compelling evidence of unlawful actions against Winston after his efforts to reform the corruption inside Countrywide. Then, after three days’ deliberation, they rendered a verdict in Winston’s favor, granting him a $3.8 million award. The presiding judge, Honorable Bert Glennon, Jr. supported the jury’s decision saying, “…there was a great deal of evidence that was provided to the jury in making their decision, and they went about it very carefully and took their time.”

After the trial, Winston was offered a private $12 million settlement to sweeten a gag order in the case of Countrywide’s malpractice. He was to speak to no one of the case from that point forward, but his request for an accompanying apology and promise of corporate reform landed him in another trial— this time in appellate court. This is where his life took a turn for the worse.

During the new trial, Winston’s pedigree was attacked with allegations — rife with perjured statements — that he was a less than an exemplary employee. The Chief Justice accepted as true misleading testimony by Countrywide’s human resources head. While the original, overwhelming verdict had been reached after a near month-long trial against BAC/CFC, this new decision against Winston was made after a 12-minute review of the case without Winston present and without even a court reporter or notary.

What is the purpose of a jury if its verdict after a one-month trial is unlawfully ignored by appellate judges? By law, the court is not allowed to substitute its opinion for that of the jury, but it did anyway.

Winston’s lawyers described the new verdict as a “travesty of justice.”

The Washington Examiner quoted California Attorney Cliff Palefsky as saying, ” This never happens… it isn’t legal… The appeals court is not supposed to go back and cherry-pick through the evidence the way this court did. And if there is any doubt about a case, they are legally bound to uphold the jury’s verdict.”

Despite these illegalities, Winston was forced to pay a staggering $97,000 in interest to Bank of America on the 3.8 million dollar jury award that he had never received.

And Winston’s hardships did not stop there. While Bank of America collected this money, Winston began dealing with a diagnosis of laryngeal cancer- making this entire ordeal much harder. However, his fighting spirit remains intact because there is too much at stake. He, along with the Bank Whistleblowers United- an organization he co-founded- has serious ambitions “to educate the populace, reign in the banks, and prevent an even more severe replay of [the financial crisis of] 2008.”

Additionally, there have been New York Times series, documentaries, and television programs on Winston’s story.

Countrywide, now regarded as the company at the heart of the sub-prime meltdown, eventually would be the subject of an SEC investigation which saw Angelo Mozilo, former CEO and Chairman of Countrywide, settle for the highest single-person fine ever levied by the Securities and Exchange Commission: $67.5 million. The Department of Justice launched a two-year investigation of Mozilo for insider trading and securities fraud and Bank of America, which acquired CFC, was fined hundreds of billions of dollars for Countrywide’s malfeasance.

Programs

Americans Who Tell the Truth (AWTT) offers a variety of ways to engage with its portraits and portrait subjects. Host an exhibit, use our free lesson plans and educational programs, or engage with a member of the AWTT team or portrait subjects.

Education

AWTT has educational materials and lesson plans that ask students to grapple with truth, justice, and freedom.

Exhibits & Community Engagement

AWTT encourages community engagement programs and exhibits accompanied by public events that stimulate dialogue around citizenship, education, and activism.